Medicare Explained

What is Medicare?

Medicare is the federal health insurance program created in 1965 for people ages 65 and over, regardless of income, medical history, or health status. The program was expanded in 1972 to cover certain people under age 65 who have a long-term disability.

Medicare plays a key role in providing health and financial security to 60 million older people and younger people with disabilities. The program helps to pay for many medical care services, including hospitalizations, physician visits, prescription drugs, preventive services, skilled nursing facility, home health care, and hospice care. In 2017, Medicare spending accounted for 15 percent of total federal spending and 20 percent of total national health spending.

More specifically, Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).

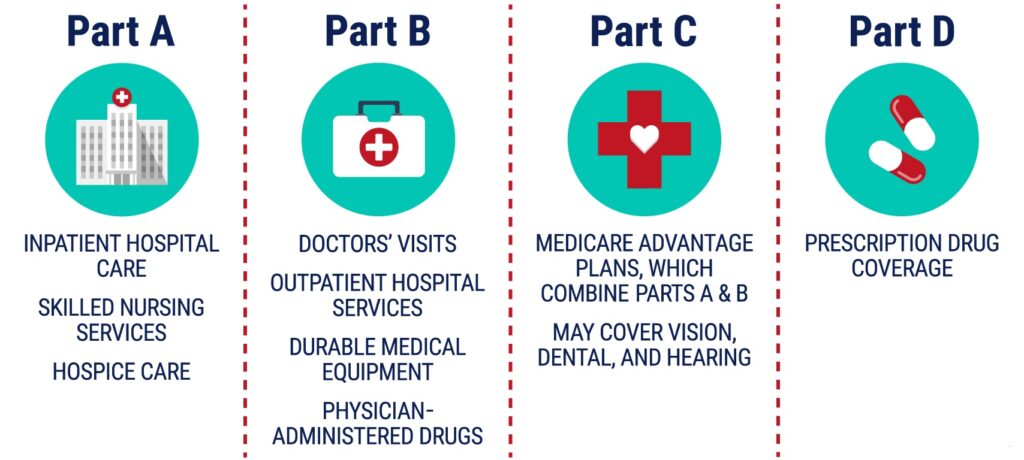

Parts of Medicare

- Inpatient hospital care: This includes all care you receive after being admitted into a hospital by a physician. Medicare covers up to 90 days each benefit period in a general hospital. In addition, you receive 60 lifetime reserve days. It also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers your room, board, and certain services provided in a skilled nursing facility. This includes medications, tube feedings, and wound care. It covers up to 100 days each benefit period. To qualify, you must have spent at least three consecutive days in the hospital within 30 days of admission to a skilled nursing facility and must have needed skilled nursing or therapy services.

- Home health care: Though it is normally covered by Part B, Part A coverage will kick in if you have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home care. Up to 100 days of daily care are covered or an unlimited amount of intermittent care.

- Hospice care: Hospice care is covered for as long as your provider certifies it is necessary.

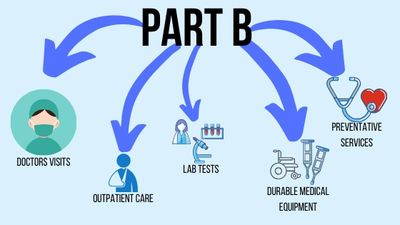

- Provider services: Services deemed medically necessary are covered under Part B.

- Durable medical equipment: Equipment that serves a medical purpose, able to withstand repeated use, and appropriate for home use, is covered.

- Home health services: If you are homebound and need skilled nursing or therapy care, you’re covered under Part B.

- Ambulance services: Emergency transportation by ambulance. Limited coverage for non-emergency transportation is available in which there is no safe alternative as long as it is medically necessary.

- Preventative services: Outpatient physical, speech, and occupational therapy services are covered as long as they are administered by a Medicare-certified therapist.

- X-rays and lab tests: All doctor ordered x-rays and lab tests are covered.

- Chiropractic care: Only when medically necessary to fix subluxation of the spine.

- Certain prescription drugs: Certain drugs such as immunosuppressants, select anti-cancer, select antiemetic, select dialysis, and other typical drugs administered by a physician.

Medicare Part C, also known as Medicare Advantage, is a private health plan provided by insurance companies contracted with the federal government.

You will still be enrolled in Original Medicare (Part A and B), however Medicare Advantage plans may offer certain benefits that Original Medicare doesn’t cover, such as:

- Dental coverage

- Vision coverage

- Caregiver Counseling and Training

- Housekeeping

- Prescription Drug Coverage

Part D is prescription drug coverage. This covers most outpatient prescription drugs.

Part D is offered through private insurance companies as either a stand-alone plan or as a set of benefits included with a Medicare Advantage Plan.

Each Part D plan has a list of covered drugs called a formulary. If the drug you need is not on the formulary, you are allowed to request an exception, pay out of pocket, or file an appeal.

These formularies differ from plan to plan so be sure to request a copy. However, each plan must cover all drugs in the following categories:

- HIV/AIDS treatment

- Antidepressants

- Antipsychotic medications

- Anticonvulsive treatments for seizure disorders

- Immunosuppressants

- Anticancer drugs (unless they are being covered under Part B)

Most vaccines are also covered under Part D unless they are already covered under Part B.

Medicare Supplement plans, also called Medigap, are designed to work with Original Medicare Parts A and B. Medigap policies help pay for some health care costs not covered by Original Medicare, such as deductibles, coinsurance and foreign travel emergency.

These plans are offered by private insurance companies and are available to people with Medicare Part A and B.

People with Original Medicare and a Medicare supplement can choose any stand-alone Part D prescription plans to pay for their drugs.

People who are enrolled in Medicare Advantage plans (Part C) are not eligible for a Medicare Supplement insurance policy.

Find Medicare Supplement Rates Now!

Use the tool below for a no cost Medicare Supplement quote today.